How Green Practices Drive Superior Returns in Bitcoin and Crypto Investments

In the ever-evolving world of cryptocurrencies, the emphasis on green practices is no longer a niche concern but a burgeoning trend driving superior returns in Bitcoin and other digital asset investments. With the growing scrutiny over the environmental impact of crypto mining, companies that integrate sustainable energy sources and eco-friendly mining operations are witnessing not only reputational gains but also tangible financial benefits. This shift is reshaping the paradigm of mining rigs, mining farms, and hosting solutions, ultimately influencing investor behavior and market dynamics.

The cryptocurrency mining landscape has historically been criticized due to its significant power consumption, especially Bitcoin (BTC) mining. Traditional miners rely heavily on fossil-fuel-based electricity, fueling concerns about carbon footprints and sustainability. However, the advent of greener alternatives — such as hydroelectric, solar, and wind power — is transforming mining farms into eco-conscious powerhouses. Miners adopting these resources manage to reduce operating costs remarkably while aligning with increasingly stringent global environmental regulations.

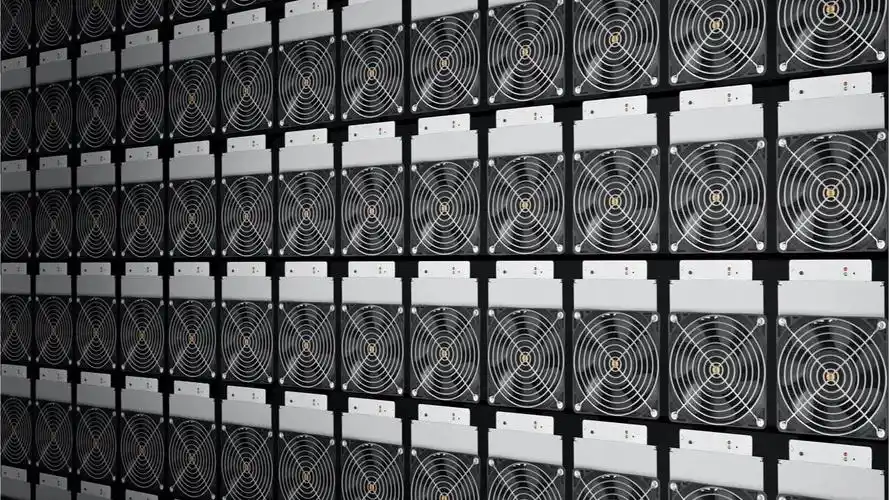

Mining machines—the heart of cryptocurrency operations—are also evolving. Manufacturers are engineering high-efficiency mining rigs that not only boost hash rates for Bitcoin miners but do so with optimized energy consumption. These technological advancements enable miners to maintain profitability even amid fluctuating coin prices and escalating electricity costs. Mining rig hosting providers seize this opportunity by offering facilities that guarantee low-cost, sustainable power, coupled with advanced cooling solutions to minimize environmental impact.

Moreover, cryptocurrencies like Ethereum (ETH) have pushed forward toward greener consensus mechanisms, such as Ethereum’s transition to Proof of Stake, thereby reducing the reliance on power-intensive equipment. This evolution impacts not only direct miners but also affects investors and exchanges by fostering a broader acceptance of digital assets as sustainable financial instruments. These developments catalyze increased trading volumes on crypto exchanges and encourage investment inflows from eco-conscious portfolios.

Dogecoin (DOG), while not as energy-demanding as Bitcoin, is increasingly entwined with green initiatives within exchanges and mining communities. Hosting platforms that support mining DOG and other altcoins are leveraging sustainable energy sources to appeal to environmentally aware users. This trend amplifies asset diversification opportunities while enhancing the overall perceived value of mining investments.

Hosting mining machines in green data centers provides a multitude of advantages beyond environmental responsibility. Miners experience enhanced uptime, reduced device wear and tear through efficient cooling, and the possibility of dynamic scaling as renewable energy access expands. This synergy between technology and sustainability yields a compelling value proposition for miners, investors, and stakeholders involved in the broader crypto ecosystem.

The financial incentives of adopting green practices translate directly to superior returns. Lower energy costs increase profit margins on Bitcoin and Ethereum mining operations, while reduced carbon liabilities mitigate exposure to potential future regulatory penalties. Investors favor companies engaged in clean mining solutions, which elevates their market valuations and access to capital. Furthermore, green mining farms and rigs become preferred partners for large institutional buyers seeking ESG-compliant crypto assets.

As the cryptocurrency industry matures, the intersection of technology, sustainability, and finance will continue to define competitive advantage. Integrating green energy solutions into mining infrastructures not only ensures operational efficiency but also signals corporate responsibility and innovation. These facets combined create a virtuous cycle that propels crypto investments toward greater resiliency and profitability.

In summary, embracing green practices in Bitcoin and broader cryptocurrency mining catalyzes superior returns by reducing costs, enhancing reputation, and opening doors to new investment channels. From advanced mining rigs harnessing renewable energy to eco-friendly hosting environments and evolving blockchain protocols, every link in the crypto value chain benefits from sustainability. For crypto miners, investors, and exchanges alike, going green is not merely an ethical choice — it’s a strategic imperative yielding measurable economic rewards.

A surprising intersection! “How Green Practices…” reveals that eco-conscious crypto isn’t just ethical, it’s profitable. Expect data-driven insights and a fresh perspective on sustainable blockchain investing.