Mining Machine Hosting Service Process: Insights and Recommendations for 2025

In the sprawling universe of cryptocurrency, the mining machine hosting service stands as a beacon for those keen to dive into digital gold but deterred by the logistical labyrinth of managing hardware. As we leap into 2025, the landscape is evolving at a breakneck pace, inviting miners—whether chasing Bitcoin’s storied halving or Ethereum’s robust smart contract network—to reconsider their strategies. Hosting services not only offload the operational burdens like cooling, electrical maintenance, and security but also usher in economies of scale, enhancing profitability for miners by optimizing uptime and efficiency.

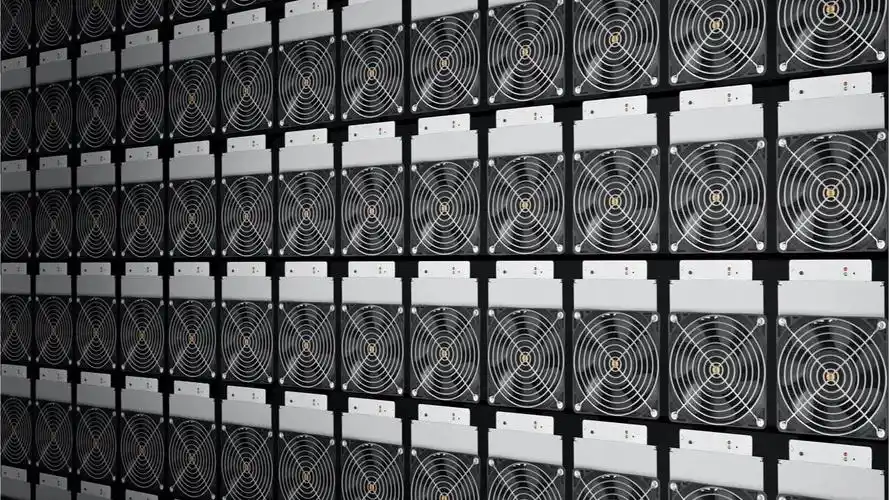

Cryptocurrency mining, specifically for powerhouses like BTC and ETH, demands relentless computational power accomplished by mining rigs—specialized hardware designed to handle the intense calculations securing blockchain networks. However, owning and operating these rigs independently often trips over hurdles: exorbitant electricity costs, heat dissipation challenges, and the relentless need for technical oversight. By outsourcing to mining farms equipped with state-of-the-art infrastructure, enthusiasts and institutional players alike can capitalize on mining rewards without the heavy operational overhead. Such farms leverage economies of scale — bulk purchasing of hardware, optimized energy contracts, and expert maintenance teams—all converging to elevate mining returns.

Delving deeper, the hosting service process in 2025 is a nuanced choreography. Initially, clients select the type of mining hardware tailored to their desired cryptocurrency—be it high-hashrate ASIC miners focusing on Bitcoin’s SHA-256 algorithm, or versatile GPUs suitable for Ethereum and other altcoins. This decision hinges on the fluctuating profit margins, network difficulty, and token valuations. Once hardware is procured and shipped, the hosting provider assumes responsibility, installing the machines in climate-controlled environments fortified with fire prevention systems and redundant power supplies.

Security is paramount. As hacking incidents and physical theft attempts escalate, mining farm operators invest heavily in surveillance, biometric access controls, and cyber protection protocols. Moreover, providers frequently offer real-time monitoring dashboards, allowing miners to track rig performance, temperature, and hash rates remotely. Such transparency is vital in a space where marginal inefficiencies can erode profitability by the hour.

Another compelling advantage lies in the flexibility of contract terms. Unlike the era where miners were shackled to owning fixed assets prone to depreciation, hosting services present scalable packages. Miners can upscale in response to bullish market sentiments or downsize during bearish phases, aligning exposure with personal risk appetites. This elasticity, coupled with transparent fee structures—covering electricity, maintenance, and hosting itself—democratizes access to mining, empowering newcomers and veteran miners alike.

Let’s not overlook the ripple effect of mining’s evolving hardware on hosting services. The advent of next-generation ASICs boasting greater energy efficiency and hashpower compels hosting providers to continually upgrade infrastructure. For instance, newer Bitcoin miners generate significant heat, challenging cooling systems and grid capacity. Forward-thinking farms are experimenting with renewable energy integration—solar, wind, even hydroelectric sources—to mitigate environmental impacts while taming operational costs, aligning crypto mining with sustainability ambitions that increasingly shape investor and regulatory sentiment.

Considering Ethereum, the network’s gradual shift toward proof-of-stake reduces reliance on traditional mining rigs but temporarily intensifies demand for GPUs during the transition phases and altcoin booms. Hosting providers have adapted by offering diversified services covering newer mining algorithms—Expanding from just SHA-256 for Bitcoin to Ethash, Scrypt, and beyond—fostering resilience in volatile market environments. Such adaptability is crucial since miners often juggle portfolios across coins like Dogecoin, capitalizing on arbitrage opportunities across exchanges where these tokens trade.

Interfacing with exchanges forms another layer in this ecosystem. Miners benefit from immediacy in liquidating rewards to optimize cash flow or hedge positions. Some innovative hosting services now partner directly with exchanges to provide integrated solutions—allowing instantaneous coin sales, real-time pricing insights, and streamlined tax reporting. This holistic approach connects mining outputs to financial markets seamlessly, enhancing the broader cryptocurrency value chain.

However, prospective clients must conduct judicious evaluations before venturing into hosting agreements. Price transparency, uptime guarantees, and strict SLAs (Service Level Agreements) are not mere formalities but lifelines that tether miners to consistent income streams. Additionally, geographic considerations—like regions with stable electric grids and favorable regulatory climates—play crucial roles in hosting service efficacy and long-term viability. With regulations tightening globally, mining farms that embed compliance at their core are better positioned to thrive amidst shifting political sunrises and sunsets.

This article provides a comprehensive analysis of the mining machine hosting service process, highlighting emerging trends and potential challenges for 2025. It offers valuable insights into optimizing operations, enhancing efficiency, and ensuring sustainability, making it a must-read for industry professionals looking to future-proof their strategies in a rapidly evolving landscape.